Whenever you find yourself in debt, any type of financial relief or loan seems like a good way to climb out of the problem. However, you must be careful as you can easily make yourself a target of a scam.

Debt relief fraud is becoming a growing issue worldwide. Scammers are using different techniques and resources to draw you into alleged problem solutions for your financial problems. They will contact you via phone, e-mail, or letters, asking you to pay upfront for their services, and disappear once they get what they want. Some will even continue to string you along and ask for more money. This is dangerous, and it can lead you to even bigger debts and a vicious circle you won’t be able to get out of.

You can protect yourself and your family by learning more about these scams. Here are the most common debt relief deceptions you can encounter.

4 Common types of frauds

1. Advances and paying upfront

The fraudsters will get you on the hook by looking authentic. Beware, because offers that you receive from them via mail or the internet will look quite believable and professional. They will ask you to pay the loan fee upfront, but the credit money will never get to your hands. These loans are usually presented with extremely low interest to get you invested. Swindlers will often change the names of their “companies” to avoid getting caught, so it is difficult to track them after you have already paid them.

There were cases when victims were lured with promised rewards and gifts after they pay the fee. Regardless of the details, the outcome is pretty much the same – you transfer the money in advance to receive something valuable and get little or nothing in return.

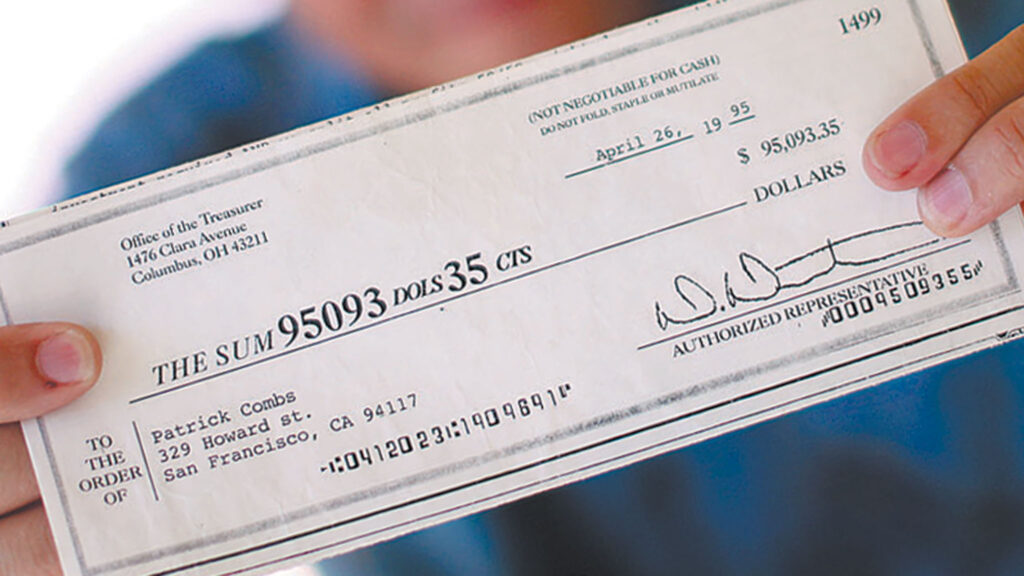

2. False cheques

Fraudulent cheques play a big role in most of the internet and (or) telephone cons. This thing alone should serve as a red flag since it’s illegal to offer loans or any form of money through phone services. Victims receive e-mails or calls about promotional or gift cheques. In order to receive them, they have to pay fees or taxes in advance. Of course, a couple of weeks later, everyone affected by this con finds out that the cheques are false and there’s no way to return the money invested in fees to get them.

3. Cutting off communication with creditors

Bogus financial companies and other scammers will request that you cut off any type of connection with creditors in order to proceed with their loans. This is, of course, the last thing you need to do if you owe the money to the bank. Ignoring your creditors might lead to a series of problems, including the lawsuit.

Swindlers have other plans for you. They lure you most of the time by lying that they will handle the communication with your lender, promising that the bank will reduce or settle for partial payment of the debt. Payment reduction is a process that requires series of talks with creditors and managers, and it definitely isn’t something that can be done overnight and with a single phone call.

4. Personal information abuse

Frauds will never give you their personal or company information unless you wire them money. They will, however, ask for yours. Starting with your first and last name, date of birth, social security number, and bank account, scammers will get every single bit of important information and they won’t hesitate to use it against you. The primary weapons exploiters use while praying on desperate people with big financial debts are usually given to them by the victims. Information you provide them with can be used in identity thefts and other different types of exploitations.

How to protect yourself from frauds

1. Contact your creditors

Contacting your creditor and appointing a meeting with the manager is the first step you should take in the debt relieving process.

A face-to-face conversation is the best way to approach this get-together as it will emphasize the seriousness and determination to resolve the problem. It’s a wise thing to do since you will know exactly who you are dealing with. By engaging in this conversation, you will get the attention of the interlocutor who will ultimately be the one who decides whether or not you are capable of meeting the bank’s and (or) loaner’s expectations. The smart move is to write down everything you learned at this meeting and politely ask the manager to sign the suggestions given to you.

Negotiate wisely. Never start aggressively and threaten that you will leave the bank or close an account in it. It will present you as an irresponsible person who just wants to avoid their commitments.

2. Always check debt settling company licenses

If you decide to pay your dues and hire a debt-settling company to do so, you need to keep an eye on a couple of things first.

Checking out the company’s website is an excellent way to start. Having a fancy site, however, doesn’t mean that the job they are doing is legitimate. By exploring further on the internet, you can get more second opinions about the company and its representation. To inform yourself a touch better, it’s fundamental to contact your state attorney general. They will advise you on whether or not the firm had previous lawsuits and if it is trustworthy. Try to investigate if the physical address is accurate. Most scammers don’t put any real contact information on websites, so consider visiting the location in person.

Legitimate firms, however, will offer you quality representation. With millions of dollars of credit card debts settled, CreditAssociates.com flawlessly built its reputation in the United States. You will be able to negotiate terms with them directly and resolve any loan issues you previously had.

There are no quick fixes when the debt needs to be paid. Tread lightly when hiring settling companies as they often don’t have attorneys to aid you. Desperation can lead to a series of mistakes, especially when it comes to owing the money, and that is the most important reason to avoid being rash. Fraudsters always leave traces and obvious clues in their deceptions, and it is crucial to double-check every fact before investing cash. Watch for the red flags we’ve listed for you and seek assistance when you’re in doubt. Share these pieces of information with your friends and family because prevention is the best way to protect your household.